As the RBA prepares to meet today, big savings are flowing to families with a mortgage — but there’s some set to miss out.

Falling interest rates and inflation are finally delivering relief to families with a mortgage, with some families set to reap a big saving of $2656 by Christmas.

In a fresh sign that the cost of living is finally showing some signs of easing for struggling families, the combined cost of interest rates and inflation easing more generally is showing some serious savings for families.

But there’s unlikely to be more joy on September 30 when the RBA meets, with most experts expecting rates to remain on hold.

In the lead up to Christmas, there’s still good news according to the Albanese Government, as the impact of the rate cuts already in the system continue to flow through to mortgage holders.

Mortgage interest costs were $31.07 billion in the June quarter of 2025. This compares to $31.85 billion in the December quarter of 2024.

The Reserve Bank has cut rates three times between February and August, slashing interest rate cuts by $800 million since the end of last year.

As a result, real incomes per capita rose 2.4 per cent in through the year terms, the fastest in almost four years.

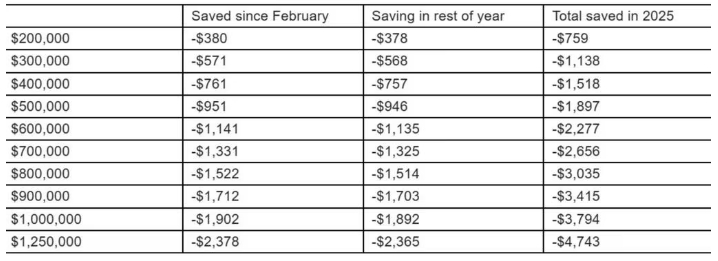

A household with a $700,000 mortgage, has already saved $1331 on their mortgage interest costs since rates started falling in February.

By Christmas, the same household will save another $1325.

That means in total by Christmas this household will have saved $2656 since interest rates started being cut in February.

By Christmas, a household with a $700,000 household will save another $1325 on top of the already saved $1331 since February.

“We’ve made a lot of progress together on inflation, which has allowed the RBA to cut interest rates three times since the start of the year,’’ Treasurer Jim Chalmers told news.com.au.

“Lower interest rates are putting more money back in mortgage holders’ pockets and that’s what these figures show.

“These are substantial savings that will make a meaningful difference in helping people to make ends meet.

“When we came to office, inflation was high and rising, interest rates were rising and real wages were falling.

“We recognise that people are still under the pump which is why we’re continuing to roll out more responsible cost-of-living relief with more tax cuts coming next year and the year after along with help with energy bills, help with the rent and help to buy a first home.”

The next RBA board meeting and cash rate announcement will be on Tuesday, September 30.

But in a less optimistic prediction for Aussie homeowners, finance experts overwhelmingly predict the Reserve Bank of Australia (RBA) will hold the cash rate at their next meeting.

More than 30 experts and economists weighed in on this month’s Finder RBA Cash Rate Survey, and for the first time in 2025, all panellists agreed that the RBA would hold the cash rate at 3.60 per cent in September.

While spending remains strong, rising inflation and increasing unemployment will keep the RBA in a holding pattern, according to Finder consumer research head Graham Cooke.

“September’s increase in monthly inflation from 2.8 per cent to 3 per cent may keep the RBA’s scissors in the sheath on (Melbourne) Cup Day if the quarterly data follows suit,” Mr Cooke said.

According to the latest monthly consumer price index (CPI), September’s headline inflation of 3 per cent marks its highest level since July 2024.

Despite the uncertainty, a majority of Finder economists predict one more rate cut in 2025, with nearly 70 per cent calling for downward movement on November 4, 2025.

“No doubt the RBA is on a slide down with the cash rate,” The University of Melbourne economist Tomasz Wozniak said.

“However, the several promised cuts will be spread over quite some time, and we should not expect a cut at every single meeting.

“My forecasts are firmly centred around the hold decision this month. I interpret this as the markets accepting the RBA’s pace of interest rate cuts.”

The past three RBA cash rate cuts were passed on in full by the four major banks.

In its latest forecast, the National Bank of Australia ruled out further rate cuts until at least May 2026 amid “higher-than-expected” inflation data.

Source: News.com.au